File Form W-2 Electronically on or before January 31, 2024. E-file W-2 now

Benefits of Filing Form W-2 Electronically with

our Software

Form W-2 State Filings

You can file your Form W-2 for the applicable states with our software, if you

need to do so. We are supporting the state filings of

W-2 Forms.

TIN Matching

Filing Form W2 online with our software will keep you away from the

TIN errors. We will validate TIN from the SSA database before transmitting the

W-2 Forms.

Postal Mailing and online access

You can send employee copies with our postal mailing option. And employees can review and download W-2 copies through the secured portal.

US based Support

We have our US based support team to address your queries

through live chat, call and email. If you need any assistance when filing W-2 Forms contact our team located in Rock Hill,

South Carolina.

Get Access To Lot More Amazing Features Right Now

Simple Steps to File Form W-2 electronically with

our Software ?

Filing Form W-2 is quite easy and straightforward. Follow these simple steps to E-file Form W-2.

- Step 1 : Choose Form W-2

- Step 2 : Enter the Form W-2 information

- Step 3 : Once the details are entered, review the Form

- Step 4 :Transmit the Form W-2 to the SSA

-

Step 5 : Send the Form W-2 copies to the employees

(Postal/Online access)

Click here, for detailed instructions for filing Form W-2 online.

Deadline to File Form W-2 electronically for 2023

tax year.

The due date for filing Form W-2 varies based on the filing methods,

Recipient Copy Deadline

January 31st, 2024.

Paper Filing Deadline

January 31st, 2024.

Electronic Filing Deadline

January 31st, 2024.

File your Form W-2 on or before the deadline to avoid late filing penalties.

Form W-2 Late Filing Penalties

If you failed to file the Form W-2 on or before the deadline. There were several penalties imposed by the IRS based on the size of the business and late filing of filing Form W-2. The IRS increased the penalties for the 2023 tax year.

| Time Period | Minimum | Maximum |

|---|---|---|

| If Form filed within 30 days | $60 /form | $630,500 per year ($220,500 for small businesses) |

| If Form filed after 30days and before August 1 | $120/ form | $1,891,500 per year ($630,500 for small businesses) |

| If Form file after August 1 | $310/ form | $3,783,000 per year ($1,261,000 for small businesses) |

Helpful Resources

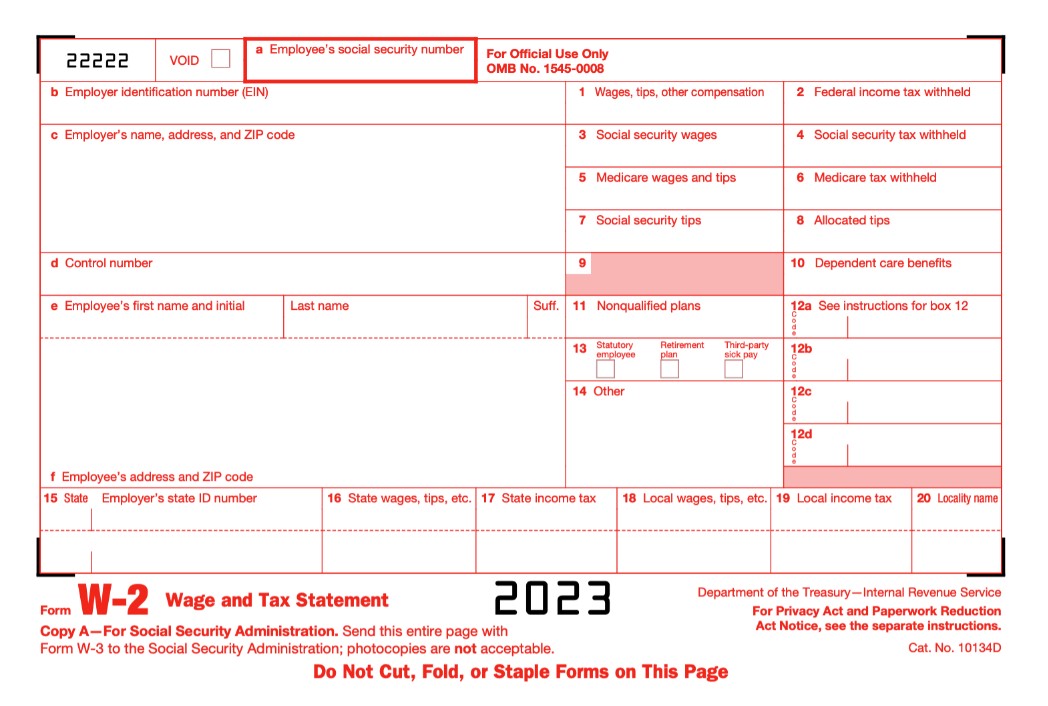

What is Form W-2?

Form W-2 Due date

Form W-2 Instructions

Form W-2 Penalties

Form W-9: Request for Taxpayer Identification Number and Certification

Invite your vendors to complete and e-sign W-9

Form W-9 is an IRS tax form used by an individual or entity to request a person's name, address, Taxpayer Identification Number (TIN) and certification from a hired contractor or vendor to e-file the 1099 information returns. IRS Form W9 is known as Request For Taxpayers Identification Number and Certification Form.

With TaxBandits online portal, employers can request w9 form online and manage all W-9 forms at one place securely. Sign up now and request the first FIVE Form W-9 for FREE.

Contact Us

We are ready to assist you! Contact our US-based support team located in Rock Hill, South Carolina by phone, email.